CLAIM: Nigerians will not be able to operate bank accounts without a Tax ID. VERDICT: Misleading. The new policy is binding on Nigerians of taxable status only. FULL STORY A claim has been shared on social media stating that starting in January 2026, Nigerians—both residents and non-residents—will need a tax identification (Tax ID) number to

CLAIM: Nigerians will not be able to operate bank accounts without a Tax ID.

VERDICT: Misleading. The new policy is binding on Nigerians of taxable status only.

FULL STORY

A claim has been shared on social media stating that starting in January 2026, Nigerians—both residents and non-residents—will need a tax identification (Tax ID) number to open new bank accounts or operate existing ones. A Tax Identification Number (TIN) is a 13-digit unique identifier assigned to Nigerians who pay taxes.

In a tweet retrieved by NDRFactHub on the 12th of September 2025, a Twitter page, “Nigerian Stories” posted, “BREAKING: From January 1, 2026, Nigerians and non-residents will not be able to open or operate a bank account without a Tax Identification number (Tax ID).”

Another X page “GistAlert9ja” posted, “FROM JANUARY 1, 2026, ALL NIGERIANS AN NON-RESIDENTS MUST PRESENT A TAX IDENTIFICATION NUMBER (TAX ID) BEFORE OPENING OR USING ANY BANK ACCOUNT.”

A screenshot of the X post

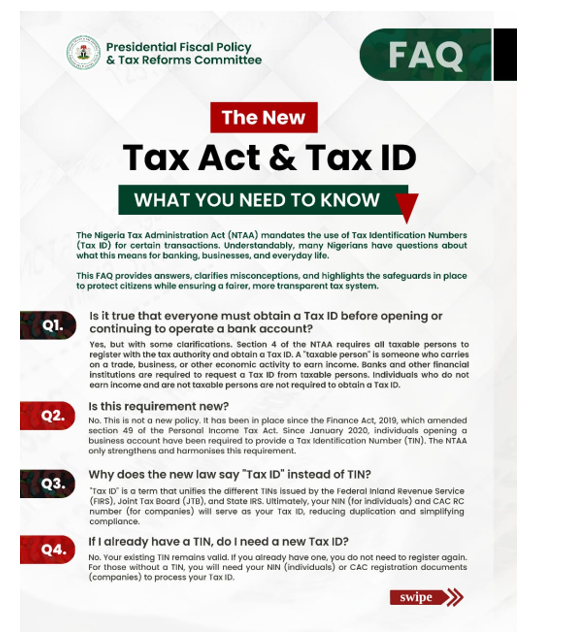

This development follows the announcement of the revised Tax Reform Act by the Presidential Fiscal Policy & Tax Reforms Committee.

The Fiscal Reforms Act states that only “taxable persons” are required to register and get a Tax ID under the Act.

Section 4 of the NTAA requires all taxable persons to register with the tax authority and obtain a Tax ID. A “taxable person” is someone who carries on trade, business, or other economic activity to earn income. Banks and other financial institutions are required to request a Tax ID from taxable persons. Individuals who do not earn income and are not taxable persons are not required to obtain a Tax ID.

The section of the Tax ID requirement

Unemployed individuals, including young Nigerians who are not of working age, are not required to have a Tax ID to open or operate bank accounts.

CONCLUSION

The claim that all Nigerians would need a Tax ID number to operate bank accounts is misleading. Findings show that only Nigerians with a source of income are required to provide a Tax Identification Number (TIN).

Additionally, the Federal Inland Revenue Service, at the weekend, explained that the country’s tax framework has been redesigned to integrate seamlessly with existing national registries. This is to ensure that every individual or entity is automatically identifiable for tax purposes without imposing new hurdles.

The Agency wants Nigerians to disregard widespread rumours on the demand for a Tax Identification Number to open or operate bank accounts. “The Tax Identification Number is a 13-digit unique code assigned to all taxable persons and entities in Nigeria. It encodes information such as issuance year, registry source (NIN for individuals, RC Number for corporates), state of registration, and a security fragment.

“Far from being a separate requirement, the TIN functions as a statutory tool that enables the FIRS to uniquely verify taxpayers across the country.”