Claim: An X user claimed that Nigerians earning #800,000 and above annually will be taxed 11% to 20% from January 2026 Verdict: False. The new tax regime exempts individuals earning ₦800,000 or less annually, while higher earners are taxed progressively up to a maximum of 25%. The claim of a flat 11–20% tax rate is

Claim: An X user claimed that Nigerians earning #800,000 and above annually will be taxed 11% to 20% from January 2026

Verdict: False. The new tax regime exempts individuals earning ₦800,000 or less annually, while higher earners are taxed progressively up to a maximum of 25%. The claim of a flat 11–20% tax rate is misleading.

Full Text:

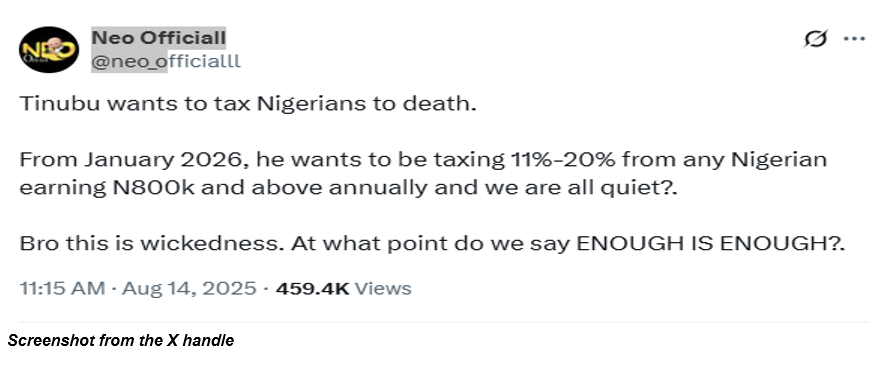

On 14 August 2025, an X user, @neo_officalll, posted a claim alleging that Nigerians earning ₦800,000 and above annually would be taxed between 11% and 20% from January 2026. His comment read: “Tinubu wants to tax Nigerians to death. From January 2026, he wants to tax 11%-20% of any Nigerian earning ₦ 800,000 and above annually, and we are all quiet? Bro, this is wickedness. At what point do we say ENOUGH IS ENOUGH?”

The tax reform, which is part of President Bola Ahmed Tinubu’s Renewed Hope Agenda, was inaugurated in 2023 with Taiwo Oyedele, Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers (PwC), appointed as the chairman of the reform committee. The objective is to create a sound fiscal policy environment and a tax system that is fit for purpose, critical for the effective functioning of government and the economy.

The bill stirred controversy in October 2024 when governors from 19 Northern states opposed aspects of the reform, particularly the derivation principle proposed as the basis for Value Added Tax (VAT) allocation. Their opposition was rooted in concerns that it would favour states with stronger economic activity while reducing revenue for weaker states.

After months of deliberation, President Tinubu eventually signed the four tax reform bills into law in 2025, with implementation set for January 2026. According to him, the reforms would enhance revenue generation, strengthen the economy, and boost both domestic and foreign investments.

The viral claim quickly gained traction online, attracting 359 comments, 1,800 retweets, 4,800 likes, and over 459,000 views as of the time of writing. Given its widespread reach and potential to mislead, Ndrfactcheckhub investigated the claim.

Verification:

According to PwC’s breakdown of the Nigeria Tax Reform Acts, the new regime introduces a progressive personal income tax system. Key provisions include: ₦800,000 or less annually → 0% tax (full exemption). Income above ₦800,000 will be taxed progressively, up to a maximum of 25% for the highest income bracket.

Similarly, the Policy and Legal Advocacy Centre (PLAC) confirmed that workers earning ₦800,000 or less annually will not pay personal income tax. Data from the Nigerian Financial Services Market Report further shows that only about 10% of Nigerians earn more than ₦100,000 monthly, meaning the majority stand to benefit from reduced tax burdens once the reforms take effect.

Conclusion:

The claim that Nigerians earning ₦800,000 and above annually will be taxed at a flat rate of 11% to 20% from January 2026 is false. In reality, the new tax regime exempts those earning ₦800,000 or less and applies a progressive structure for higher earners, with rates ranging up to 25%.