Claim: Purported online loan App, FastCent recently claims to be offering a #500,000 grant on the authority of Access Bank, Opay, Sterling and Globus Bank. Background Story Numerous microfinance banks have sprung up in recent times, offering credit facilities to many Nigerians, particularly in the informal sectors. Many customers have been

Claim: Purported online loan App, FastCent recently claims to be offering a #500,000 grant on the authority of Access Bank, Opay, Sterling and Globus Bank.

Background Story

Numerous microfinance banks have sprung up in recent times, offering credit facilities to many Nigerians, particularly in the informal sectors. Many customers have been very comfortable with applying for and receiving loans from these facilities simply because of their online presence and responsiveness.

Other merits of these loan facilities include minimal documentation, little or no collateral, and flexibility in loan repayments.

However, fraudulent Apps have become so prevalent in recent times due to the proliferation of digital lending platforms. While the nationally approved loan Apps by the Central Bank of Nigeria are quite well known and can be verified by the receiving public, there are countless of them, ranging from unapproved to suspicious and outright fraudulent ones.

As of the last count, 47 suspicious online loan Apps have been delisted from the Google Play Store, according to the Federal Competition and Consumer Protection Commission (FCCPC).

Despite the continuous delisting, it was reported that some unregistered loan Apps still operate through Android Package Kit (APK) which is shared in the form of a link. When this link is clicked, it takes the user to a file to download an App not listed on any app store.

Reports have also shown that fraud loan Apps run freely on social media platforms. As such, claims of fake loan Apps have been previously fact=checked here, here and here

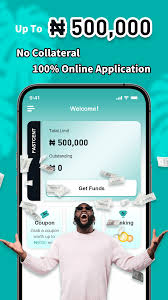

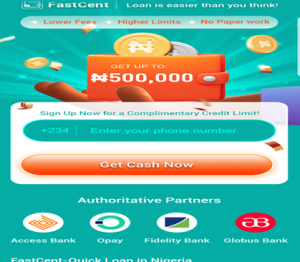

Currently, a loan App, Fastcent is advertising on social media, asking the public to request from #3,000 up to #500,000. See the screenshot of the advert below:

Screenshot of the downloaded Fastcent App

The App, which claims to be acting on the authority of Access Bank, OPAY, Fidelity Bank, and Globus Bank, promises a long-time loan repayment ranging from 91 days to 365 days. It also promises an interest rate of 36% APR Maximum with an equivalent maximum monthly interest of 3%.

Part of the conditions for granting the loan include being of Nigerian nationality, between the age of 22 and 55 years old.

Many online loan conditions are often juicy and very attractive. This has led borrowers most of whom are low-income earners to jump at them. Most people have even fallen victim to being scammed of their hard-earned savings. It is against this backdrop that we verified the authenticity of the Fastcent loan App.

Verification:

First, we tried to check the status of this loan App on the Federal Competition and Consumer Protection Commission’s website. We discovered that it was neither on the watchlist of loan Apps, registered nor among the licensed Apps by the Central Bank.

Another attempt to also check its presence on any Play Store proved abortive as the search came up with nothing.

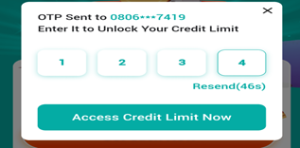

When this researcher clicked on the link provided on social media, it went straight to a downloaded form (the screenshot is posted above), suggesting that the loan App operates through Android Package Kit (APK) and is not listed on any app store. This is a red flag as operators behind this App often evade official regulations.

Screenshot of the OTP sent to this researcher

Our attempts to get the purported “Authoritative partners” such as Access Bank, OPAY, Fidelity Bank, and Globus Bank to respond to this development also proved abortive as messages sent to their mailboxes and social media handles were not replied to.

However, the information regarding the process of receiving quick loans is provided on the websites of Access Bank, OPAY, Fidelity Bank and Globus Bank.

When we subjected the App address to further verification through a Whois Domain search, results showed that it was truly registered as fastcent.net with the registrant’s address showing Guang dong province in China.

However, there was no evidence that the domain name: fastcent.net had any connection with the purported Facebook loan App which the sources behind it claimed to have their office at 34, Borno Way, Alagomeji, Yaba Lagos.

A screenshot of the office location claimed by Fastcent

In summary, from all indications, the Facebook Loan App purportedly acting on the authority of Sterlin Bank, OPAY, Fidelity Bank and Globus Bank is faceless. The App is not only unregistered and fabricated, but the sources behind it are also usurping the identity of a different registered domain name.

Verdict: The App content is, therefore, fabricated

1 comment